The cost of hiring a permanent employee extends beyond their base salary, it includes their total compensation, taxes, benefits package, and additional overhead expenses. With these comprehensive costs to consider, coupled with the pressures of tight deadlines and high-demand orders, many employers turn to contract hiring as a solution to prioritize cost efficiency. But why is contract hiring the cost-efficient choice?

When hiring a contingent worker, the staffing firm that recruited the worker typically acts as the designated “employer on record,” handling recruitment and administrative tasks such as payroll, benefits, and legal compliance while the worker carries out duties at client companies. This arrangement enables companies to efficiently manage and allocate resources that help financially save on various employer-related expenses like:

- Employer Taxes and Business Liabilities:

Employer taxes and other corporate obligations typically add 10-15% on top of the employee’s base salary. For an employee with a base salary of $100,000, the total added cost for taxes and business liabilities can reach up to $14,975. Here’s the breakdown:

-

- Employer Taxes: 9.65% of $100,000 = $9,650

- Workers’ Compensation: $3,000

- Other Business Liabilities (Office Supplies, Legal Compliance, Equipment Insurance, etc) $3,500

With contingent hiring, the responsibility for payroll taxes, including Social Security, Medicare, federal and state unemployment taxes, and workers’ compensation premiums, typically falls on the staffing firm rather than the client company. Staffing firms also often have robust compliance measures, reducing the risk of potential legal issues or penalties related to misclassification or non-compliance with tax regulations.

- Payroll:

Payroll platforms typically operate on subscription models, with providers offering tiered pricing based on the number of employees. Monthly fees range from $29 to $150, with additional charges of $2 to $12 per employee per pay period.

Outsourcing payroll to a proficient staffing firm saves a company in overhead costs by utilizing specialized personnel for time tracking, paycheck processing, employer tax obligations, compliance with employee classifications, and benefits administration. This approach reduces the burden for internal payroll staff and minimizes expenses associated with software, training, and compliance efforts.

In addition, contingent workers managed by the staffing firm offer added flexibility and scalability in workforce management since they are not included in the company’s headcount.

- Benefits:

For a salaried employee earning $100,000, here are the additional benefit costs that significantly increase the employee’s overall compensation package:

-

- Health insurance: $7,739 for single coverage or $22,221 for family coverage

- Dental insurance: $600 per employee on average

- 401(k) retirement plan contributions (4.5% of the employee’s gross pay): $4,500.

- Paid time off (PTO): $3,846.15 average for 14 days

A well-equipped firm usually offers competitive benefits to contingent workers, ensuring they receive necessary coverage while relieving the client of the financial burden associated with full-time employee benefits.

By utilizing staffing firm-employed contingent workers, the client company can significantly reduce costs related to employee benefits.

- Recruitment:

Staffing firms specialize in sourcing and recruiting for challenging positions like engineering, offering their expertise on placement-based contract terms. This means they are paid only upon successful placement, relieving companies of the full cost of recruitment while having access to specialized talent.

Another benefit of this payment structure is that expenses are incurred only when hiring needs arise, alleviating financial burdens during low-demand periods. Since fees are implemented solely upon successful placement, the agency’s interests align with those of the hiring organization.

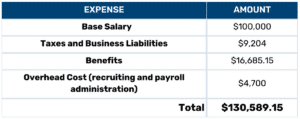

Here’s an example of the binding costs you need to cover for an engineer with a base salary of $100,000:

The Switch to Contract Employment:

As 84% of companies that adopted contract hiring experience cost savings, around 32% of US companies replaced salaried employees with contingent workers in 2021. Now, contingent workers make up 40% of the US workforce, with 83% of global executives turning to them for business needs. The growth rate of contingent workers in the US is at 64.8% and is expected to reach a significant 90.1% by 2028.

For companies seeking to optimize costs without compromising on talent, hiring engineers on a contingent basis through a reputable staffing firm presents a strategic solution. By leveraging the expertise and resources of staffing firms, businesses can access top engineering talent while mitigating the financial risks and administrative burdens associated with traditional hiring practices. The flexibility of contingent arrangements allows for agile scaling of engineering teams based on project needs, ensuring efficient resource allocation.

To explore how your company can benefit from contingent engineering staffing solutions, contact SoloPoint Solutions today and unlock a cost-effective pathway to exceptional engineering talent.