- With the passage of AB-5 into law, businesses need to review if the workers they engaged as Independent Contractors meet the standards of the ABC Test.

On September 18, 2019, the state of California passed Assembly Bill (AB) 5 into law, which uses the ABC Test as the standard for classifying workers as independent contractors as of January 2020.

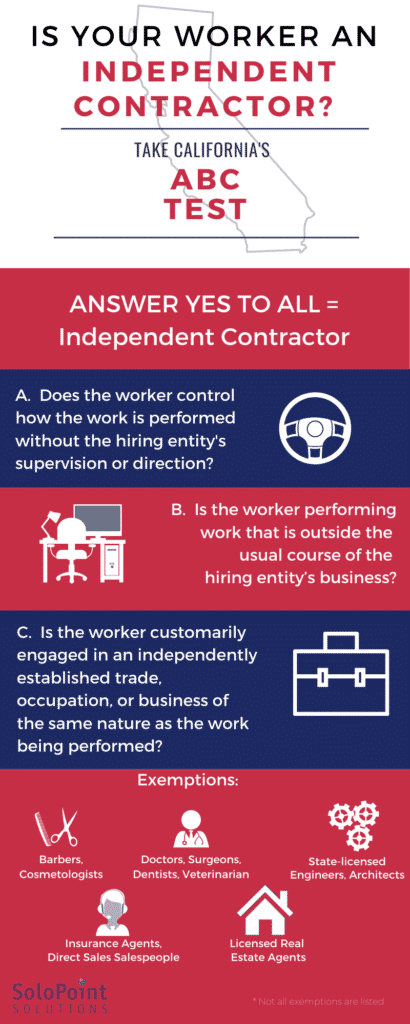

Using the ABC Test, employers must adhere to a three-prong factor to determine if a worker is an independent contractor, or more commonly known as 1099 (based on the tax form the worker receives at the end of the year), rather than the multi-factor standards implemented by the California Supreme Court in the case of S. G. Borello & Sons, Inc. v Dept. of Industrial Relations (1989).

Based on these changes, here are some items that businesses might want to take action on in order to prevent misclassification fines:

- Review all workers engaged as 1099

According to California’s Department of Industrial Relations (DIR), workers who are engaged with businesses as 1099 should be reviewed for compliance with the ABC standards. Even with a prior agreement that a worker is to be identified as 1099, the Labor Commissioner and courts will look into the actual relationship of the worker and hiring entity, and determine if the standards of the ABC Test are met.

- Reclassify workers who do not meet ABC Test Standards as W-2.

- Pay employer costs to federal and state agencies – The DIR said that misclassification of workers as Independent Contractors results in a loss of payroll tax revenue to the State, estimated at $7 billion per year. Companies who are classifying workers as W-2 employees need to pay employment taxes which include state and federal unemployment, disability, social security, and possible Affordable Care Act (ACA) fees if health insurance was not provided to the worker

- Offer workers salary and benefits – 1099 workers are usually paid as vendors with pre-agreed upon fees for services rendered. With W-2 employees, companies need to pay the workers’ salary, overtime and also extend employee benefits such as sick leave, paid time off, health and dental insurance, etc. On top of that, companies need to add these workers under their business liability and workers’ comp insurances.

- On-boarding – Since working with a 1099 is a business-to-business relationship, the hiring entity does not need to verify the worker’s legal work status or handle tax withholdings. Employers must require W-2 employees to fill out I-9 forms, W-4 forms, and other employee forms to add them to the company’s payroll. In addition, companies may need to conduct background checks, drug screens, and new employee training.

The passage of the ABC Test makes all employers eligible for audit by the Labor and Workforce Development Agency. Under California Labor Code Section 226.8, businesses that misclassify workers as 1099 can be fined between $5,000-15,000 per violation. Fines increase to $10,000 to $25,000 for repeat offenders.

Other than the fines listed above, California state law also imposes penalties which include repayment of back payroll taxes, subject to interest and a 10% penalty on the unpaid taxes.

Companies in California routinely engage engineering professionals on a 1099 capacity to address brief upswings in workloads or for short-term projects. To avoid misclassification, consider changing the workers’ status to W-2 and outsource the employment obligations to SoloPoint Solutions. We are well-versed in state and federal Labor Laws and are fully equipped to handle employment compliance requirements.

Our employee leasing services allow you the ability to focus on your business’ core operations while we take care of employment compliance.

To find out more, contact us today!