In recent economic reports on market predictability within the Manufacturing, Sciences, Technology, and Supply Chain sectors – the overwhelming theme is for organizations to stay resilient in adapting to the “new normal” post-pandemic.

Over the next few months, we’ll be exploring how these markets stay resilient amidst the uncertainties of this ever-changing COVID-19 landscape.

This month, we’ll explore how the Manufacturing Sector is pushing to build a “disruption-proof” resiliency:

As workplace restrictions get lifted and consumer purchasing continue to rise, we expect to see the following trends take place in manufacturing this year:

ANTICIPATE DEMAND INCREASE:

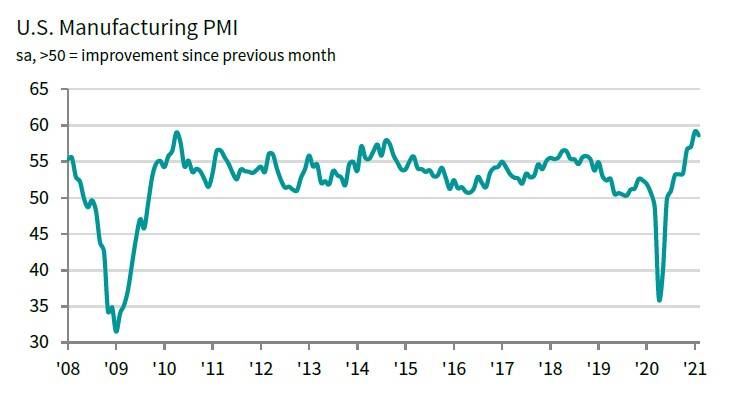

Manufacturing companies should optimistically anticipate higher business demands as IHS Markit reported that as of February 2021, the US Manufacturing Purchasing Managers’ Index™ (PMI™) is up to 58.6 – a vast improvement from the PMI levels of the mid-2020s when it was hovering the 35 mark. This score shows manufacturing demand eclipsing its former pre-pandemic levels.

(Image Source: IHS Markit)

Chris Williamson, IHS’ Chief Business Economist, said, “Particularly encouraging is a marked improvement in demand for machinery and equipment, hinting strongly at strengthening business investment spending. However, new orders for consumer goods showed the strongest back-to back monthly gains since the pandemic began, suggesting higher household spending is also feeding through to higher production.”

3D PRINTING EXPANSION:

When COVID-19 restrictions on international imports led to critical shortages on Personal Protective Equipment (PPE), the healthcare sector turned to 3D Printing for faster, on-demand production of vital supplies for frontline workers. This ranged from face masks to testing kits to even large emergency dwellings for COVID patients. With its proven ability to produce equipment in emergency situations, 3D Printing reliance is expected to rise and be more widely adopted in manufacturing medical devices, as well as other essential products.

RE-SHORE PRODUCTION AND SUPPLIERS:

With the uncertainties that came with international trade disputes and the aforementioned pandemic import restrictions, confidence in overseas partners for supply sources and manufacturing is at an all-time low. In a recent Deloitte survey, 31% of US manufacturing executives are exploring how to expand their production closer to domestic markets and develop production capabilities in markets like Canada and Mexico. This movement could lead to large investments towards automation and in specialized manufacturing talents.

MIXED WORKFORCES:

Speaking of talent… In that same Deloitte report, it was mentioned that the majority of manufacturing leaders seem unlikely to return pre-pandemic work arrangements. In a recent poll, 61% of surveyed executives are planning to develop a hybrid model for their production and non-production processes over the next three years, with more focus on engaging contingent workers, and upskilling current ones.

If you are looking to make your manufacturing workforce more agile in meeting production demands, contact us today: